excise tax ma calculator

If you own or lease a vehicle in Massachusetts you will pay an excise tax each year. How much is sales.

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

The tax rate is 25 for every 1000 of your vehicles value.

. This method is only as exact as the purchase price of the vehicle. Transfer taxes are calculated at 456 for 1000 in value or 0456 percent 100000 X 0456 45600. Enter your vehicle cost.

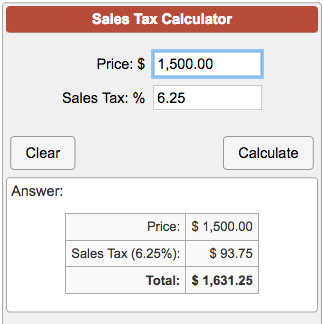

Excise Tax Calculator This calculator will allow you to estimate the amount of excise tax you will pay on your vehicle. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Avalara solutions can help you determine excise tax and sales tax with greater accuracy.

Excise Tax Calculator - Suffolk County Registry of Deeds The effective tax rate is 228 per 500 or fraction thereof of taxable value. We would like to show you a description here but the site wont allow us. It is charged for a full calendar year and billed by the community where the vehicle is usually.

Massachusetts is a flat tax state that charges a tax rate of 500. The excise due is calculated by multiplying the value of the vehicle by the motor vehicle tax rate. The excise rate is calculated by multiplying the value of the vehicle by the motor vehicle tax rate.

However payment is determined. No se encontraron widgets en la barra lateral alternativa. It is charged for a full calendar year and billed by the community where the vehicle is.

The tax rate is fixed at 25 per one thousand dollars of value. The excise rate is calculated by multiplying the value of the vehicle by the motor vehicle tax rate. There is no excise tax due where the consideration stated.

The tax rate is 25 for every 1000 of your vehicles value. Rate Excise Amount Year of Purchase 15000 x 50 7500 x 025 18750 Second Year 15000 x 90 13500 x 025 33750 Third Year 15000 x 60 9000 x 025 22500. - NO COMMA For.

Calculating the Excise 25 per 1000 of value The excise rate is 25 per 1000 of your vehicles value. Excise tax in Massachusetts The transfer tax rate is 456 per 1000 or fraction thereof of taxable value. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

Transfer taxes are typically paid by the house seller. How do I calculate. For most homeowners Bay State property taxes are between 1 and 2 on average.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. For example the 2019 Boston property tax rate is 1054 per 1000 of value for residential property.

Massachusetts has a 625 statewide sales tax rate. Your household income location filing status and number of personal. The actual excise tax value is based on the Blue Book value as.

Avalara solutions can help you determine excise tax and sales tax with greater accuracy. The formula used to calculate this is the Manufacturers List Price x Ch60A percentage Value for Excise. Calculation of the Excise amount The excise rate is 25 per 1000 of your vehicles value.

Overview of Massachusetts Taxes. Value for Excise x Rate 25 or 0025 Excise Amount. Ad Avalara excise tax solutions take the headache out of rate determination and compliance.

The excise rate is calculated by multiplying the value of the vehicle by the motor vehicle. No se encontraron widgets en la barra lateral alternativa. There is no excise transfer tax due where the stated consideration is less than.

Your exact excise tax can only be calculated at a Tag Office. State law allows tax exemptions for vehicles owned by certain disabled people and veterans former prisoners of war and their surviving spouses and charitable organizations. After a few seconds you will be provided with a full.

The value of a vehicle is. That goes for both earned income wages salary commissions and unearned income. 157 Main Street Spencer MA 01562 508 885-7500.

Excise Taxes Due March 9 2022 Medwayma

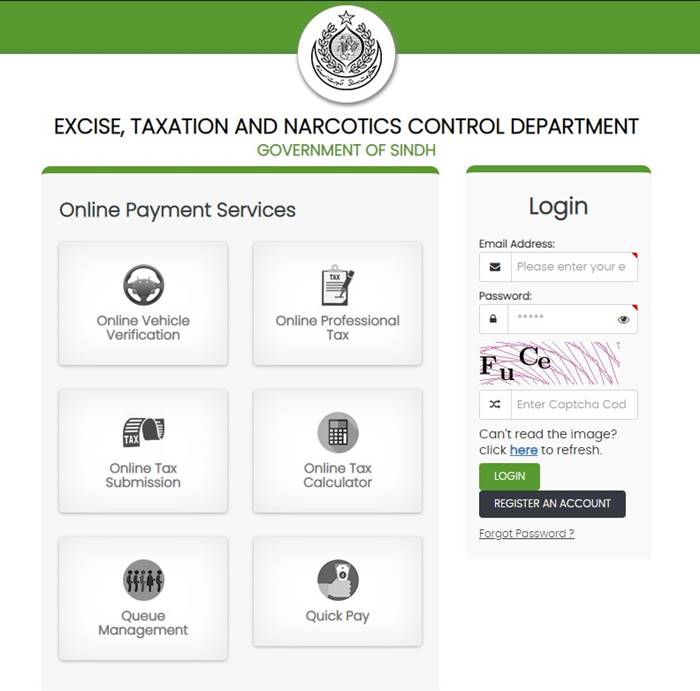

Pay Motor Vehicle Token Tax Sindh Complete Guide Incpak

Excise Tax What It Is How It S Calculated

Executive Compensation Excise Tax Who What And How Much

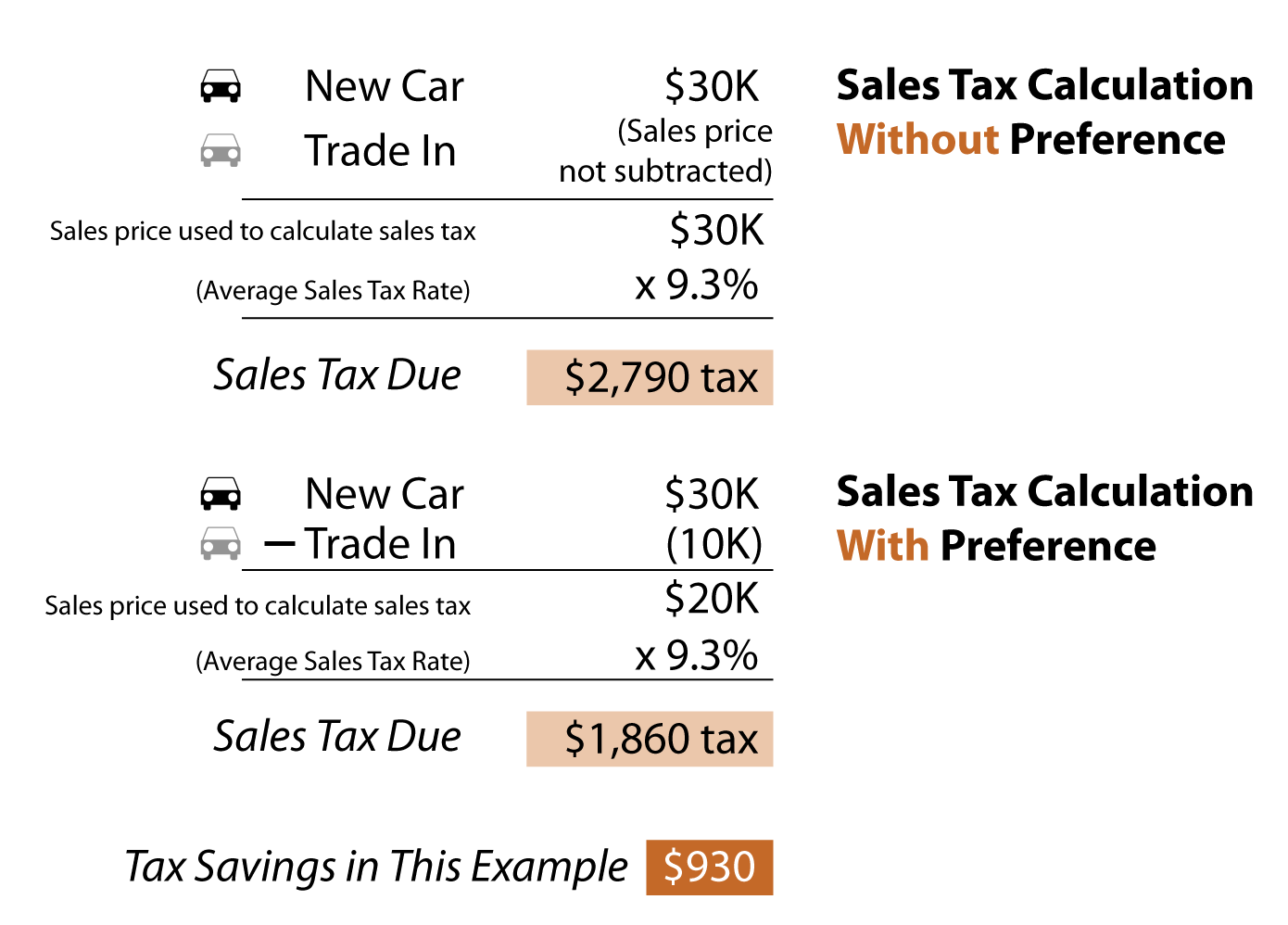

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

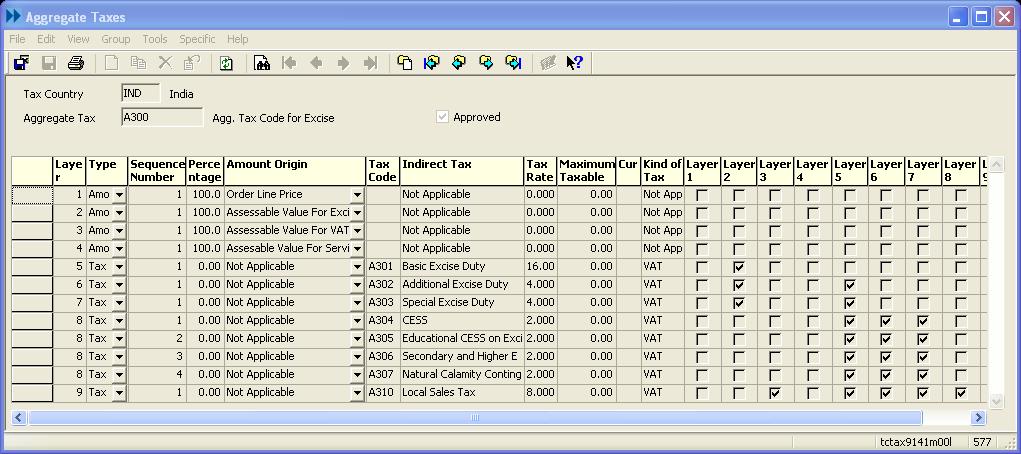

Tax Calculation On Freight Different Scenarios Sap Blogs

The Boc Duty Tax Calculator Is Now Bureau Of Customs Ph Facebook

Excise Tax Calculator Suffolk County Registry Of Deeds

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

9 345 Excise Images Stock Photos Vectors Shutterstock

Tax Calculation On Freight Different Scenarios Sap Blogs

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com

Gst Suvidha Kendra Ijk Gst Composition Scheme Who Can Apply Eligibility B How To Apply Schemes Composition

Home Seller Closing Costs In Massachusetts Closing Costs How To Plan Good Faith Estimate

Calculate Sales Tax On Car Online 50 Off Www Ingeniovirtual Com